Is ‘Full Coverage’ Insurance Enough in Tennessee?

With the Garza Law Firm, clients explore the ins and out of their insurance coverage to ensure the outcome is everything they expect and more.

When clients involved in car wrecks consider whether they need legal assistance, we first delve into the crash details before discussing insurance matters. If our client is not at fault, we concentrate on their injuries and vehicle damage, outlining our role in securing compensation for their losses, typically involving monetary compensation.

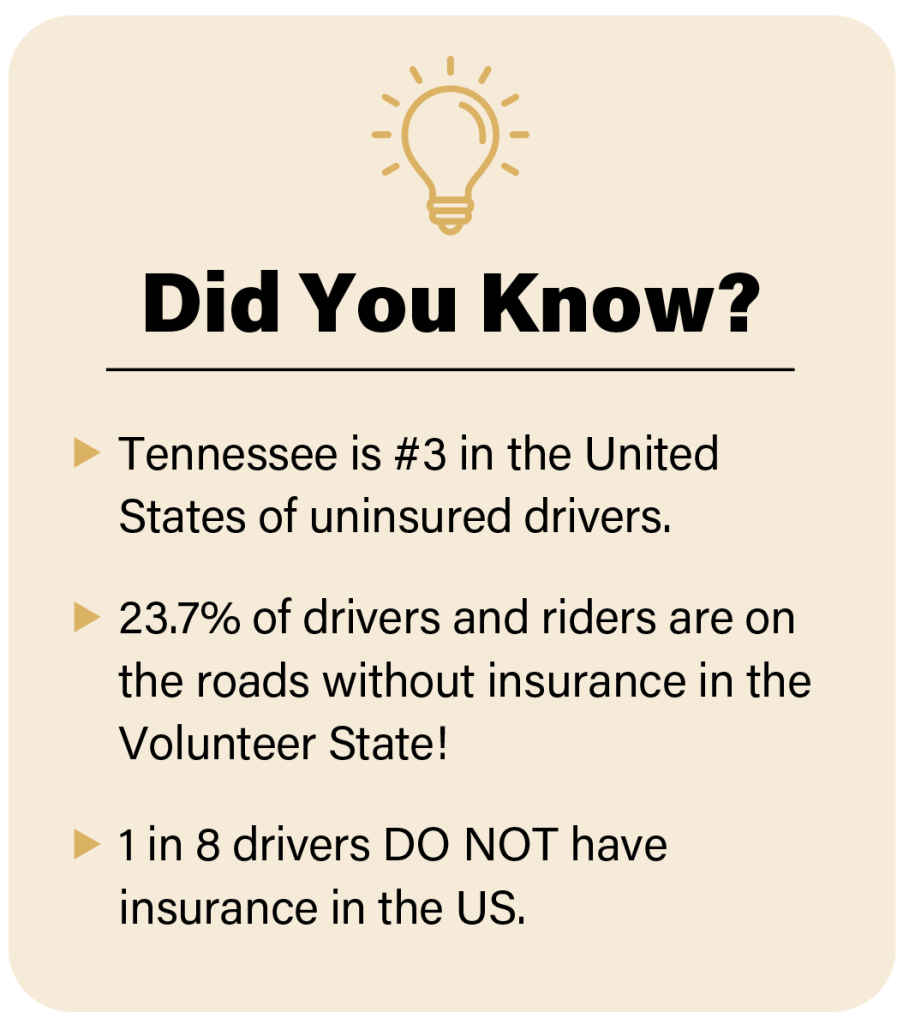

But where does this compensation originate? Who covers the injury costs? Generally, the funds are provided by an insurance company, which might belong to either the at-fault party or our clients themselves. It’s rare for the responsible individual to cover injury and damage expenses personally. The crash report often indicates if the liable party had insurance, yet inaccuracies can occur. This is why we address your insurance during our client relationship.

Most discussions begin with, “Yes, I had full coverage.” While that’s good to hear, it doesn’t always tell us everything we need to know. What exactly does “full coverage” include? Does it cover things like accidents with drivers who don’t have insurance? Does it help with medical bills? How much money can it provide? The client, despite having “full coverage,” often does not know the answers to these important questions and often does not have one or several of these coverages.

Exploring the ins and outs of car insurance reveals that there could be gaps that leave drivers dealing with unexpected financial problems. That’s where two important types of coverage come in: uninsured motorists (UM) coverage and medical payments (MedPay) coverage. UM coverage is like a shield that protects you if you’re in an accident with someone who doesn’t have insurance or if they run away. It makes sure you’re not stuck paying for their mistakes. MedPay coverage is like a safety net for medical expenses. Even if you have full coverage for your car, it might not be enough to cover all the medical costs. MedPay steps in to help with medical bills for you and your passengers, no matter who caused the accident.

Think about “full coverage” like this: Imagine you want to protect your parked car from hail damage. To “fully” protect it, you can use different types of covers. You decide to use a thin bed sheet with holes in it—you could say your car is “fully covered,” but it’s not well protected. Or you might use two brand-new flannel sheets—that’s also “full coverage.” And if you use a heavy, thick winter blanket, your car is also “fully covered.” The difference is clear in these examples. The heavy winter blanket does the best job, giving the most protection.

So, which situation describes your car insurance?

To ensure complete coverage, we encourage you to request a copy of your declaration page, which outlines the details of your policy. Speaking with your insurance agent can help answer any questions you may have. Here at Garza Law Firm, our team of attorneys is fully trained in the insurance needs of Tennessee drivers. As a free service, we will gladly review your policy to confirm that you and your family are adequately covered. Don’t let knowing if you have “full coverage” be by accident.

550 W. Main Street #340, Knoxville, TN 37902 | (865) 540-8300