Business owners need any and every advantage available to be able to continue to effectively compete. Finding relief in the form of government programs that offset the damage done by Covid is a gamechanger.

It was about two months ago that I met Don Lawson. I received a letter from Don regarding the ERC. I was pretty sure that I didn’t qualify because we had gotten a Payroll Protection Grant, but I was curious so we agreed to sit down. From the beginning, I thought this could make a great article and this would be my chance to drill down and get all the facts. What I came out of the meeting with was far more than I had expected.

I’ve spent some more time with Don recently, learning a bit more about how he got into this field. It’s not every day you meet someone with his level of third-level specific knowledge about a subject, so it felt worth it to spend a few hours with him.

I came to find out that Don’s always had a passion and a talent for finance, and he has spent decades in the industry proving it. “I love dealing with people,” he tells me, “but from early on I always have this knack for finance and numbers.” It seems it was about more than simply crunching numbers, though. “I wanted to get into the finance world to not only change my life, but be able to change other people’s lives as well.” It’s certainly a good reason to spend your life doing something. I feel similarly about Cityview.

After graduating from the University of Tennessee Knoxville with a dual degree in accounting and finance, Don spent 12 years working as a commercial lender in Knoxville. Along the way, he earned a Master’s degree from Louisiana State University’s Graduate School of Banking. Eventually, when he struck out to build his own company more than a decade and a half ago, Don’s focus on helping businesses came front and center, and he worked diligently to establish a pipeline for companies who needed help with a variety of challenges from navigating complex business scenarios and structuring deals for real estate developers to arranging financing and constructing successful business plans, whether they be for start-up companies or established ones. Smart Business Accounting, Don’s company, has since become a trusted resource for businesses looking to grow or evolve.

The ERC

Constant consultation with businesses has always put Don at the forefront of understanding the lay of land in the business community. That’s part of what led him to learning more about the Federal Employee Retention Credit program, or ERC.

If you’re unfamiliar, the Employee Retention Credit program, created under the 2020 Cares Act, came about in response to the economic impact of the pandemic, offering refundable tax credits for a portion of the wages paid per employee during 2020 and 2021 for qualifying businesses. “It was designed to help businesses keep their employees working during the pandemic by giving them money to pay payroll for these employees,” Don explains. I was aware of the credit at the time, but have learned so much more about it since Don and I connected.

For the 2020 ERC, the relief caps at $5,000 per employee, but for the 2021 ERC a business can get as much as $21,000 per employee – numbers that can add up fast for some companies.

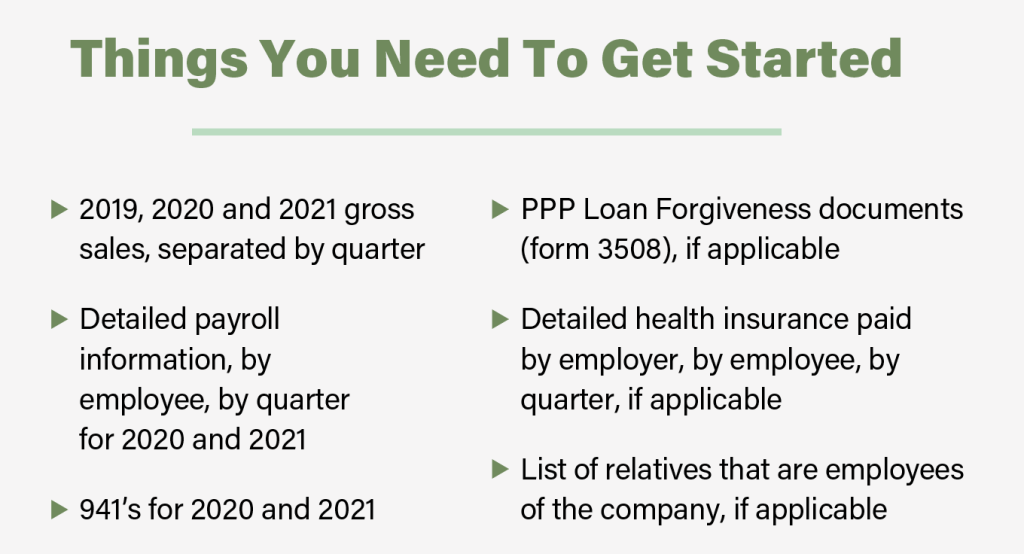

For close to a year, amidst his other work with clients, Don spent hours researching and understanding everything there was to know about the ERC. At more than 28,500 pages in length, along with nine different amendments that have come about in just the last two years, the credit paperwork is a tangled web, but Don recognized the enormous opportunities that rested within those pages for local businesses. At the same time, he realized that most businesses would fail to utilize the program as a result of its complexity. Especially when many of us business owners had already utilized the second flagship program of the Cares Act: the Paycheck Protection Program, or the PPP.

“At the time, in March of 2020, all the way through 2020, if you did one, you were excluded from doing the other, and so many businesses did the PPP,” Don says. “The PPP was a very simple, streamlined program that got them money the very next day and so right at the beginning of the pandemic when everyone first had a choice, it became instantly clear that the PPP was going to be the path of least resistance. They have since amended the law to say that you can now do both.”

From the client standpoint, all they’re needing to do is provide me financial records and sign the initial documents.

We do everything else to see if they qualify.

– Don Lawson, Smart Business Accounting

But at nearly 29,000 pages, the law is far from accessible for most of us. Aside from not knowing even if they qualify, it’s a maze to even understand where to start and how to get through all the paperwork until you receive your full benefits. So Don breaks it down. His deep understanding of this program and amendments has helped hundreds of businesses understand if they qualify. We’re one. And he has made himself into one of the foremost experts on the program in the region. He’s confident he can get any qualified business the money they are entitled to; and quite frankly, I’m confident in that too.

“Most businesses tell me that things are worse now than they were even during the pandemic and so much of that is inflation, supply chain issues, and labor. They’re struggling. But if I can get a small business $50,000, that’s life changing for them.”

Of course, there are caveats and exceptions and a whole circus of hoops to jump through to make it happen, but that’s where Don’s expertise lies. He’s done the legwork so business owners can be confident they’ll get their money without spending a year buried in legal documents. It was a game changer for me. “From the client standpoint, all they’re needing to do is provide me financial records and sign the initial documents,” Don ensures. “We do everything else to see if they qualify.”

Local Impact

Knoxville Harley-Davidson was the first business Don assisted in the program. With dozens of employees, the potential for a big payout for the company was exceptional, and like many businesses, regaining these funds was critical.

“Our owner owns four motorcycle dealerships, running with around 80 employees, and he refused to lay people off,” says Tonya Ensor, Business Office Manager at Knoxville Harley-Davidson. “He wasn’t going to send people home. He was going to make sure that his people were still working and still being paid 40 hours a week when other places were sending people home or laying people off. The ERC makes up for that.”

But like many of us, leaders at the company were worried that they would get mired down in an endless sea of legal paperwork, as the company they were originally working for was asking so much. “I was originally encouraged to work with a different company, but they were making things very, very tedious. When Don reached out to me, when he realized the lag time and tedious process they were requesting, he immediately stepped in and took the reins,” Tonya says. “I think when I was most impressed with him is when he realized how much of the job they were asking us to do, when he felt it should have been their job. He was extremely helpful and made the process as smooth as possible. He’s kept in contact with me so that I knew what was going on through the process.”

“We sat and talked,” Don says of those initial meetings with Knoxville Harley-Davidson, “They believed in the product, they believed in me and said, ‘Hey, listen, we would like to move forward with this.’”

Ready to find out if you qualify?

Harley-Davidson was hardly the only business that faced challenges during the pandemic, though. And many in our region have turned to Don and his team, like Mike Pope over at Pope’s Plant Farm. Mike owns three garden centers in the region with about 200 or so employees. “Our sales weren’t the problem, our problem was our expenses,” he says. “A container ship went from $3,500 to $20,000. Fertilizer went from $24 a bag to $44 a bag, and I was afraid I wasn’t even going to be able to get it, so I bought two tractor-trailer loads – that was $200,000. Of course, payroll was up. The natural gas bill went through the roof.”

Like Harley-Davidson, Pope’s has received only a portion of their payment but more are coming as they finish filing for them. “He’s been honest with me,” Mike says. “And I’ve been honest with him, and things have just worked out fine.”

Don has transitioned into working on ERC cases full time now; the need is so great that he says it has completely filled his calendar. As of this writing, he’s helped nearly 500 companies, from breweries and restaurants to manufacturing companies and hotels— in securing millions of dollars from the ERC program. His largest client to date received roughly $6.8 million from the program.

But it’s not just big businesses that benefit. Don regularly works with small business, too. He told me once about doing an ERC project for an operation that only had one employee, which ultimately brought in $12,000 for the business. “We’re just happy to help,” he says, “no matter the size of your business.”

None of us know how much money remains in the program.

The program will be over before we know it, and it will almost certainly run out of money before it runs out of time.

– Don Lawson, Smart Business Accounting

On top of all this success for the business community, Don and his team make time to give back to the community further by doing this work for local nonprofits. Having benefitted from children’s charities as a youth, Don ensures community organizations like the ones that helped him in his early formative years have the opportunity to see if they qualify for the credits. “When he found out what we did, working with foster children, it just touched his heart,” says Denise Melton, executive director of the House of Hope. Don’s work has helped House of Hope and many other nonprofits continue and grow in their important work in our community.

The Time is Now

The window to get your ERC money may be closing sooner than we think. While the deadline for a 2020 ERC application is April of 2024, and the deadline for a 2021 ERC application follows in April of 2025, Don warns that the real deadline may be much sooner than that. “None of us know how much money remains in the program,” he says. “The program will be over before we know it, and it will almost certainly run out of money before it runs out of time.”

I don’t often do stories like this, but I’ve taken the time to learn more about Don’s process and talk with other fellow business owners in the region who have worked with him to make sure this is legit. Moreover, I stand behind my endorsement of Don and his company because I personally trusted him to handle Cityview’s ERC filing and am proud of the work he’s doing in the community to help businesses in East Tennessee survive and prosper.

I want to ensure other members of our community have the same opportunity. And Don doesn’t charge for his services unless he is successful in assisting companies receive the ERC funding.